pa estate tax exemption

Cases that have been granted tax exemption will be reviewed every 5 years to determine continued need for exemption from certain real estate property taxes. Ra-retxpagov Please do not send completed applications or personally identifiable.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

An estate tax is a federal or state levy on inherited assets whose value exceeds a certain million-dollar-plus amount.

. Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill. PA-30 Elderly and Disabled Tax Deferral Application. Each year over 100000 individuals receive benefits from this 41000000 plus program.

A sells the real estate subject to Xs lease to P for 1 million. This exemption is portable. Forms and Instructions - Exemption Tax.

Additional instructions for the conditional Homestead Exemption. Statement of Qualification - Life EstateTrusts must be filed with PA-29 PA-35 fillable PA-35 print Assessing Officials Response to ExemptionsTax CreditsDeferral Application. Find a licensed contractor and contractor information.

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by. The Tax Relief section processes these applications and determines eligibility for the program. The County Board for the Assessment and Revision of Taxes will grant the tax exemption.

The property must qualify for a homestead exemption. Get a nonprofit real estate tax exemption. A representative of the estate must be present at the.

Do not jeopardize your Homestead by renting your property. TCA 67-5-701 through 67-5-704. The computation of the tax is as follows.

Homestead Tax Exemption About The Taxpayer Relief Act. 2019 Exemption. To sort forms by Form Number or NameDescription click on that item in the table header.

The Tax Relief Program began in 1973 as a result of the 1972 Question 3 constitutional amendment. Tax to be paid to recorder on transfer to P2000. The Senior Exemption is an additional property tax benefit available to home owners who meet the following criteria.

If youre applying for a conditional Homestead Exemption you must submit. This means that with the right legal maneuvering a married couple can protect up. The rate of inheritance tax upon the transfer of property to or for the use of a child 21 years of age or younger from a parent who dies after December 31 2019 shall.

The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. PA-29 Permanent Application for Property Tax CreditExemptions. Estate expenses funeral and burial costs probate fees attorneys fees and the family exemption are just some of the potential deductions.

PA-35 Assessing Officials Response to ExemptionsTax CreditsDeferral Application. At least one homeowner must be 65 years old as of January 1. Tax on transfer to P10000 Tax on lease to X-8000.

Property or services qualify as building machinery and equipment and will be transferred pursuant to a construction contract to name of tax-exempt entity and if an institution of purely public. Further if the decedent created the joint interest in the property within a year of hisher death the full value of the property is taxable in the decedents estate. The contents of safe deposit boxes must be inventoried before they can be removed.

Who conducts safe deposit box inventories. The Homestead Exemption saves property owners thousands of dollars each year. There is still a federal estate tax.

The exemption certificate should be properly executed given to the vendor within sixty days of purchase and should contain the following statement. A leases real estate to X for a 50-year term and tax is paid in the amount of 8000. Please visit the Tax Collectors website directly for additional information.

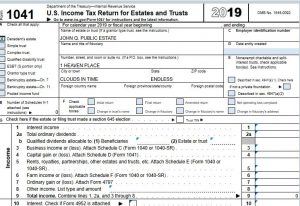

Pennsylvania Department of Revenue Tax Types Sales Use and Hotel Occupancy Tax Non-Profit Begin Main Content Area Page Content. Must complete PA Form REV-487 Entry Into A Safe Deposit Box To Remove A Will Or Cemetery Deed to record the entry and mail it to the PA Department of Revenue. United States Estate and Generation-Skipping Transfer Tax.

Total Household Adjusted Gross Income for everyone who lives on the property cannot exceed statutory limits. In order to determine the amount due under the PA Inheritance Tax a Personal Representative must ascertain the value of the decedents assets as of the date of death. The federal estate tax exemption is 1170 million in 2021 and 1206 million in 2022.

Get a real estate tax adjustment after a catastrophic loss. PA-33 Statement of Qualification - Life EstateTrusts must be filed with PA-29.

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Estate Gift Tax Considerations

Pennsylvania Estate Tax Everything You Need To Know Smartasset

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

61 Pa Code Chapter 31 Imposition

States With No Estate Tax Or Inheritance Tax Plan Where You Die

61 Pa Code Chapter 31 Imposition

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation