franchise tax board phone number for llc

1 2011 a passive entity that is registered or required to be registered with either the Texas Secretary of State or the Comptrollers office must file Form 05-163 to affirm that the entity qualifies as passive for the period upon. REVIEW YOUR LLC CONTACT INFORMATION.

Llc California How To Start An Llc In California Truic

Effective for franchise tax reports originally due on or after Jan.

. It is filed with Form 3522 LLC Tax Voucher. Mailing addresses list of ftb mailing addresses. Contact number of franchise tax board sacramento ca the contact number of franchise tax board sacramento ca is 800.

FTB may record a lien against taxpayers when their tax debts are overdue. If you have ever registered a business in the State of California as an LLC you will know that there are annual fees. While California Assembly Bill 85 affects multiple aspects of the state budget were focusing on how it affects people forming an LLC in California.

Type of Contact For Limited Liability Companies and Stock Corporations For Nonprofit Corporations. Nexus for franchise tax reports due on or after Jan. You can also contact the California Franchise Tax Board for further questions.

Franchise Tax Board Exempt Organizations Unit MS F120 PO Box 1286 Rancho Cordova CA 95741-1286. State of California Franchise Tax Board Corporate Logo. As of Thursday May 26th 2022 we are still getting.

If you have a lien or levy that was issued by FTB call 1-800-852-5711 to learn more or refer to Financial Hardship. California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. Entity Name Between 3 and 70 characters Entity Name Search.

California charges your business an Annual LLC Franchise Tax of 800. Dimovtax November 4 2016. Weekdays 7 AM to 5 PM.

FTB notifies taxpayers 30 days before recording the lien. Customer service phone numbers. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee.

Entity Status Letter requests made within this period will show the old entity name until FTBs records have been updated. Franchise Tax Board Business Entity Correspondence PO Box 942857 Sacramento CA 94257-4040. FTB Voluntary Administrative Dissolution.

You must submit proof of the LLCs timely amended return or claim for refund for the tax year selected in STEP 2 AND proof that the LLC paid the LLC Fee for that year. However as a service company with an established history with the revivor unit we are able to adjust our policies to meet their current conditions. Monday Friday 8am 5pm PT.

The excise tax is based on net earnings or income for the tax year. Company just now california franchise tax board contact phone number is. After the voice gets past asking you if you would like.

888-635-0494 Collections option 3 option 3 option 0. Franchise Tax Board FTB Our mission is to help taxpayers file tax returns timely accurately and pay the correct amount to fund services important to Californians. Franchise Tax Board PO Box 942857 Sacramento CA 94257-0631.

These fees are 800 per year for just having an LLC in CA even if you have a loss. Help with Entity ID. A proposed settlement has been reached in a class action lawsuit against the California Franchise Tax Board FTB challenging the constitutionality of the LLC Fee imposed on limited liability companies LLCs for tax years 1994 through 2006 Proposed Settlement.

The California Franchise Tax Board FTB has agreed to pay 22 million as part of a settlement to resolve claims it charged LLC companies unconstitutional tax fees. Entity ID 7 or 12 numbers only no dashes Entity ID Search. FTB Revivors A Division of SOS Filings Incorporated.

You can only submit claims for tax years 1994-2006. Here is how to contact an actual operator at ca franchise tax. To contact a human being at the FTB the number to call is 800-852-5711.

Their hours are Monday through Friday 8 AM to 5 PM - Avoid calling Monday mornings as there will be heavy traffic. Set location to show nearby results. To search enter either an Entity ID or Entity Name.

After that you will also need to pay another 800 in annual franchise tax due on April 15 every year. If the taxpayer does not respond FTB records a lien with the county recorder. The LLC Fee or Levy means the tax that LLCs were.

The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the. California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. To pay that you need to file Form 3522 called the LLC Tax Voucher.

Limited Liability Company FTB 3557 LLC Mail Business Entity Correspondence Franchise Tax Board. The claim form deadline has been extended to Aug. Answer 1 of 5.

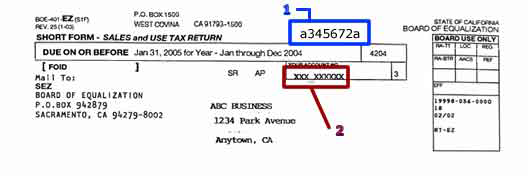

If you start to operate an LLC business in California you need to pay the first 800 fee in the 4th month after the approval of your LLC. The Comptrollers office has amended Rule 3586 Margin. Sales and Use Tax.

FTB Notice of Balance Due for LLCs. Use FTB 3522 when paying by mail. Make sure you are calling the right number.

Due to the COVID-19 pandemic the Franchise Tax Boards protocols have changed. Here is how to contact an actual operator at CA Franchise Tax Board. California Assembly Bill 85 changed Section.

The FTB settlement benefits LLCs that paid an LLC tax fee based on their worldwide total income previously. Then you get assessed additional fees based on the amount of sales you make. Reporting Change for Passive Entities.

Franchise Tax Board PO Box 942857 Sacramento CA 94257-2021. 1 If you simply need to ask someone questions about your business dial this number. A California LLC can now legally avoid the 800 Annual Franchise Tax 1st year California Assembly Bill 85 was signed into law by the governor on June 29th 2020.

The undersigned certify that as of July 1 2021 the internet website of the. A foreign taxable entity with no physical presence in Texas now has nexus if during any federal accounting period ending in 2019 or later it has gross receipts from business done in Texas of 500000 or more. Limited liability company LLC forms an LLC to run a business or to hold assets to protect its members against personal liabilities.

Phone or email to appropriate area for extra help. Phone Hours of Availability.

How To Start An Llc In California Legalzoom

State Corporate Income Tax Rates And Brackets Tax Foundation

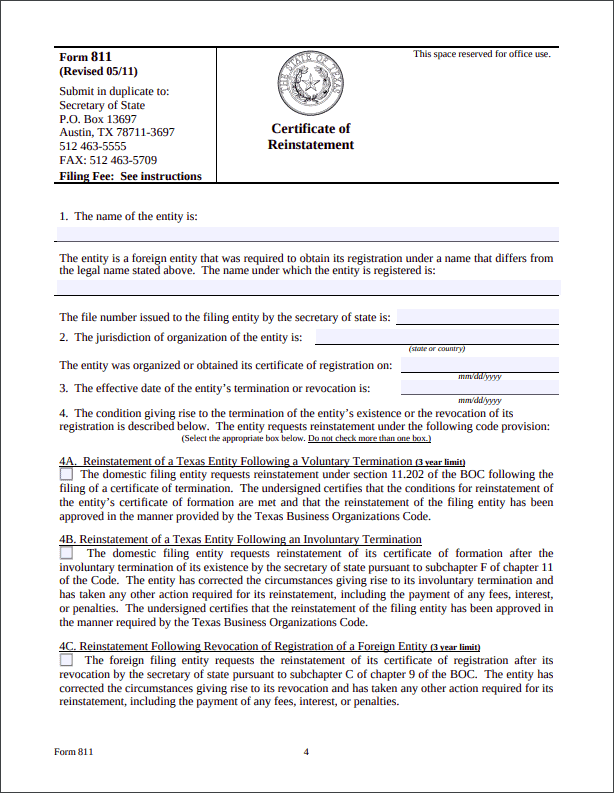

Free Guide To Reinstate Or Revive A Texas Limited Liability Company

What Is Privilege Tax Types Rates Due Dates More

Irs Form 540 California Resident Income Tax Return

2021 Form 540 2ez Personal Income Tax Booklet California Forms Instructions Ftb Ca Gov

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

![]()

Llc California How To Start An Llc In California Truic

What Is The Annual California Franchise Tax Legalzoom

What Is The Annual California Franchise Tax Legalzoom